Ipê News #20 - Rio AI City, Stablecoins in Venezuela, Composable ID.

Your weekly update on what is happening in the Startup Society ecosystem.

Your weekly update on what is happening in the Startup Society ecosystem.

Hey builders! Welcome to the 20th edition of Ipê News.

🏘️ Community Updates

What’s happening inside the Ipê ecosystem.

Get ready for Ipê Village 2026 and make sure to book your tickets before the prices increase. Now only $400, the tickets will increase by $50 every 15 days from January 1st until April. For more information, check out our launch article.

Our next Town Hall is on Friday, January 16th, 10 am BRT. Join us to celebrate 2026 and learn what the community has been up to.

🏫 Learning

Composable identity treats digital identity as a set of reusable proofs rather than a single, static profile. Instead of repeatedly creating accounts or exposing full personal data, you present only the credentials required for a specific context.

Verifiable Credentials (VCs) make this possible. A credential can prove something like “attended an event,” “verified contributor,” or “completed a program.” The issuer digitally signs it, the holder controls when and where it’s shared, and any verifier can independently check its authenticity.

This model makes identity more private, portable, and adaptable, especially for network societies where people move fluidly across communities, apps, and jurisdictions.

🌐 Network Societies Update

New communities, pop-ups, and startup cities shaping the future.

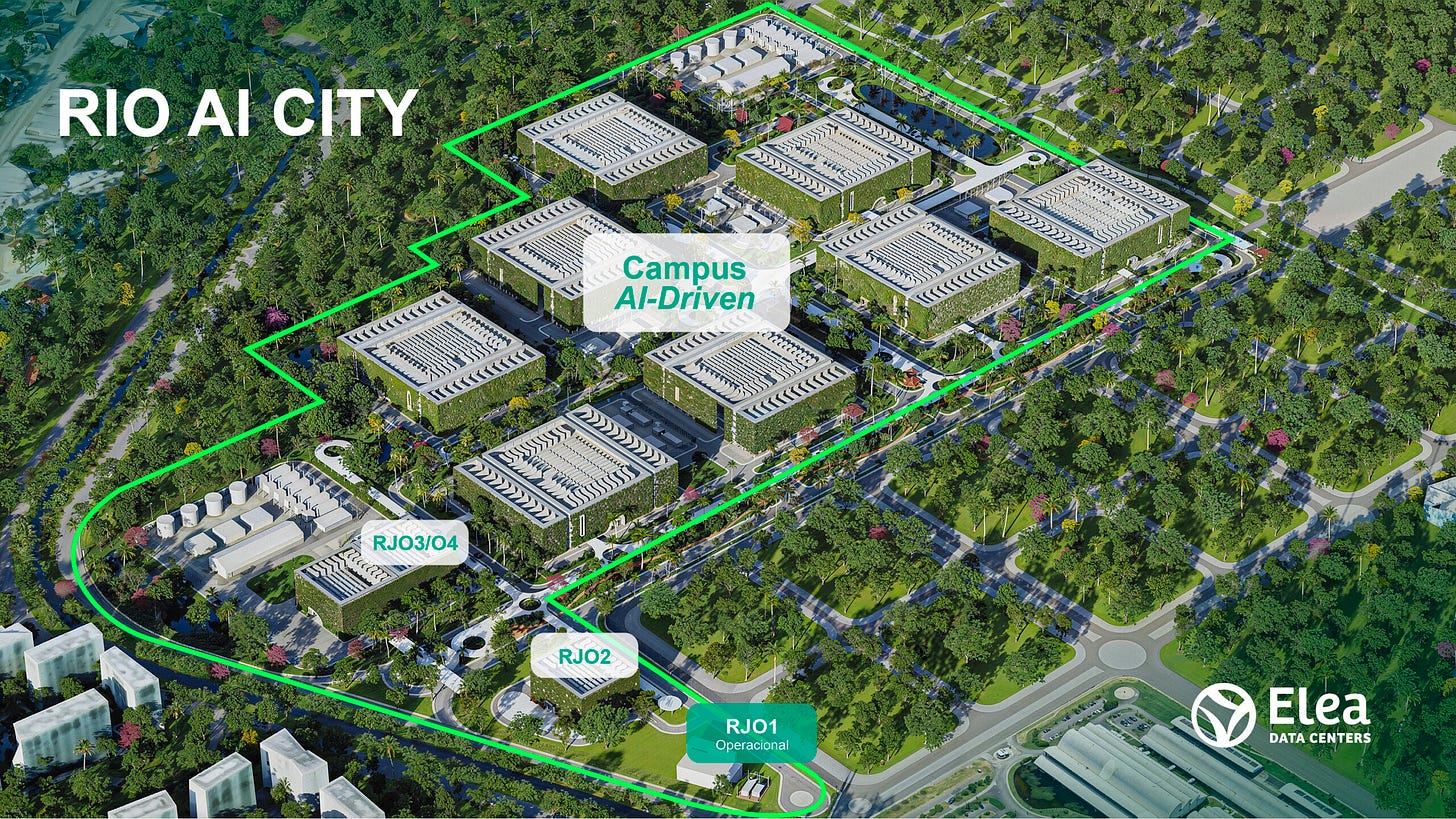

Rio de Janeiro is transforming its Olympic legacy into a global digital infrastructure hub with the launch of Rio AI City. Located at the former Olympic Park, the project is a partnership between Rio City Hall, Elea Data Centers, Oracle, and NVIDIA.

The plan is to convert a 900,000 m² site into one of the world’s top ten AI hubs by 2032. The campus is expected to launch with 1.5 GW of capacity in 2026 and scale to 3.2 GW powered entirely by renewable energy, roughly matching the electricity consumption of the entire city of Rio.

The design emphasizes sustainability through green-skin architecture and waterless cooling systems, while integrating with the Mata Maravilha urban regeneration plan. Beyond data centers, the project includes residential zones, longevity hubs, and educational spaces aimed at AI researchers and digital nomads.

With a projected investment of $65 billion and more than 10,000 high-skilled jobs, Rio AI City positions Brazil as a serious contender in the global AI and compute race.

⚖️ Governance Tools

Crypto and AI tools for coordination, law, and community management.

DAOs are beginning to treat AI not just as a tool, but as a governance participant. In this model, known as agentic governance, autonomous AI agents analyze proposals, vote via delegated power, manage treasuries, and execute actions based on predefined goals.

Token holders increasingly delegate votes to AI agents to handle complexity, reduce bias, and operate at machine speed. Some DAOs also allow AI to generate proposals, allocate capital, and monitor security risks in real time.

The benefits are speed and scale. The risks are misalignment, opaque decision-making, and new attack surfaces. As a result, most experiments are converging on hybrid governance, where AI operates within strict limits and humans retain oversight, override powers, and ethical control.

Agentic governance is no longer theoretical. It is an emerging governance primitive reshaping how decentralized systems coordinate.

🛠️ Parallel Institutions

Startups and protocols building alternatives to legacy systems.

Stablecoins in Venezuela (Parallel Finance)

The capture of Nicolás Maduro has brought renewed attention to how Venezuela kept financial flows alive under heavy sanctions and a collapsed banking system.

According to reporting by The Wall Street Journal, Venezuela’s state oil company increasingly relied on USDT to settle oil exports, bypassing correspondent banking restrictions. Estimates cited by economists suggest that up to 80 percent of Venezuela’s oil revenue was collected through stablecoins rather than traditional banking channels. At the same time, hyperinflation and the collapse of the bolívar pushed millions of Venezuelans to use stablecoins for savings, remittances, and everyday payments.

This case highlights a critical distinction in parallel finance. Stablecoins can operate outside legacy banking infrastructure and provide real economic utility at scale, but they remain centrally issued and governed. Unlike Bitcoin, they are not censorship-resistant by design and depend on issuers that comply with regulatory and geopolitical constraints.

💡 Join Ipê Village 2026

Build the future with us.

Ipê Village 2026 will be the next step to establish physical tech districts across the globe. It’s a large-scale experiment exploring new models for communities, cities, and governance.

When & Where: Florianópolis, Brazil, April 6 to May 1, 2026

If you are a techno-optimist, join us!

See you next week 🌱